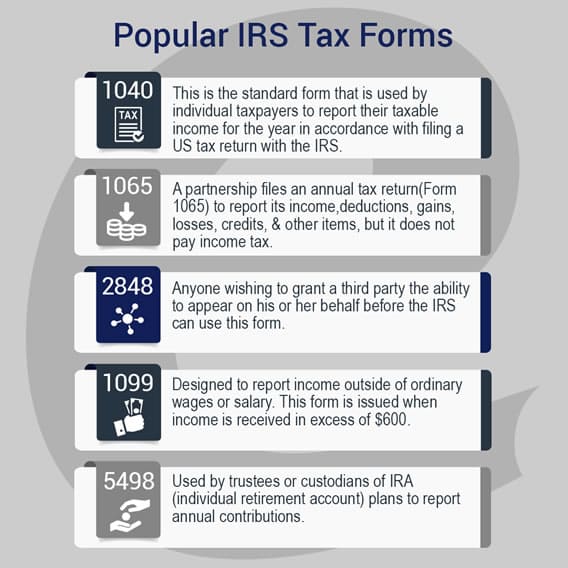

The state and federal versions of Form 1065 are similar. For states that let businesses form LLCs online, they may also need the company to report their income by filing Form 1065. A hardship waiver can be requested from the IRS if it will be too difficult to file Form 1065 online. If there are more than 100 members, it needs to be filed online. Filing of Form 1065įorm 1065 can be filed online by the LLC. Every owner will report their prorate share for credits, deductions, and corporate income on this form. When an LLC files as an S corporation, they will need to file Form 1120S, which is the U.S. This is the tax return for corporate income, and no flow-through items to Form 1040. The LLC should file Form 1120 if it's a corporation. They also have the option as a partner to file an income tax return. A benefit of how the LLC structure works is that under state law, the owner can have a limited liability of the corporate shareholder. Shareholders will need to pay taxes again when dividends are received. Federal taxes must be paid by the income that corporations earn. It's normally a better option for an LLC to be a partnership instead of a corporation for the purpose of income tax. It will be necessary to file Schedule SE if the business has over $400 of net income. The LLC will automatically be classified under the default rules if they don't file Form 8832.

It's necessary to fill out Form 8832 when filing to change what the LLC's classification is. They can also choose to be an association taxable. If a business entity has a sole member, it can be disregarded as an entity that's different from its owner, known as a disregarded entity. When a business has a minimum of two members, they can decide to be classified as either a partnership or a corporation. If an LLC isn't classified as a corporation automatically, they can file Form 8832 to choose the classification of their business entity. Form 8832 must be filed by the LLC in order to pay income taxes. Some states will let one person own an LLC, which means they have sole proprietorship. If the partnership doesn't file Form 8832 specifically, it will be taxed by the IRS as it's a partnership with multiple owners. The standard filling status for an LLC is the partnership structure. A business can file taxes as either a corporation or a partnership. A business may choose to be an LLC under their state, but the government won't let them file federal income taxes when they're an LLC.

Partnerships Income, is required when filing earnings for a business partnership. Updated November 2, 2020: What Is an LLC 1065?įorm LLC 1065, or Return of U.S. What Is Included in the Income Statement? Do I Have to File Form 1065 if LLC Has No Income or Expenses? 6.

0 kommentar(er)

0 kommentar(er)